Fund Source India provides Real Estate Finance for real estate developers to complete their construction projects which have good marketable potential & secures high returns on investments. This loan facility can be raised in all major cities of India & loan amount starts from Rs.5 crores to any highest amount required. This loan facility can be used for newly launched projects or mid-way to last-mile projects or even for stalled/stuck projects. We also take over the previously running loan in the project whether it is running smoothly or with irregular repayments and provides the additional funding to complete the project.

We access the project details to explore the best possible financial solution & extend the loan facility with tailor-made repayment options.

If you are looking for finance in India for your real estate construction projects, then look no further just contact us for the best financial facility & to complete your dream project.

Real Estate Finance is a loan facility specifically designed for real estate developers to complete their ongoing or newly launched projects with a facility of a moratorium and a specially designed repayment plan as per the sale of the project. This loan can be taken for completing residential as well as commercial projects. Loans given under this facility will be disbursed in tranches to secure the construction of the suggested portion.

Real Estate Finance Company in India

Fund Source India is a premium real estate finance company in India, that provides finance facilities to real estate developers, builders, and real estate construction projects.

Fund Source provides start-to-finish finance facilities to complete an ongoing project or a stalled project, and to launch a new construction project. Our easy finance options are even suitable for builders having bad credit ratings or NPA issues in the current project.

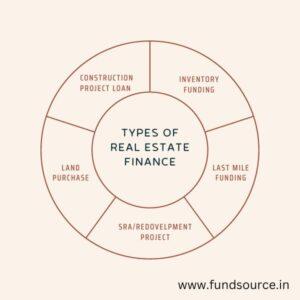

Our funding is available in all major cities of India and for residential as well as commercial projects. We Provide finance for:

India’s No.1 NPA funding & OTS Finance Company with Proven Track Record. We are exclusively working for Private Finance for NPA Accounts (NON-PERFORMING ASSET)